The Myth of Experience

To have lived and experienced the events of the last three years is a blessing enough on its own. Even more so to the investor, for having a historic learning opportunity to witness how market cycles unravel in unprecedented times. The outbreak of the COVID-19 pandemic, the rattled financial markets that ensued, and the immediate economic boom that unraveled — defining historical events. Meanwhile Abranova, the vertically integrated real estate construction development firm I founded at the end of 2016, maintained its growth momentum by raising capital and acquiring some of its most strategically located sites for our pipeline during this same period. I’m under no illusion to think that this was normal. As entrepreneurial as I’d like to believe our team is, we’ve greatly benefited from the extraordinary tailwinds that started with the onset of the Global Financial Crisis of 2008 (herein referred to as the GFC). This was before I was fluent in English, well before I had even set foot in America as a freshman at the Duke Pratt School of Engineering.

You may wonder why I’d dare to insinuate that the GFC, as devastating as it was to the economy, triggered tailwinds that paved the way for Abranova’s growth a decade later. To expound on this, I’ll quote Howard Marks, the CEO of Oaktree Capital who oversees assets of about $170 billion:

“Most people think of cycles in terms of the phases listed above and recognize them as a series of events. And most people understand that these events regularly follow each other in a usual sequence: upswings are followed by downswings, and then eventually by new upswings. But to have a full understanding of cycles, that’s not enough. The events in the life of a cycle shouldn’t be viewed merely as each being followed by the next, but — much more importantly — as each causing the next.” (Marks 37–38)

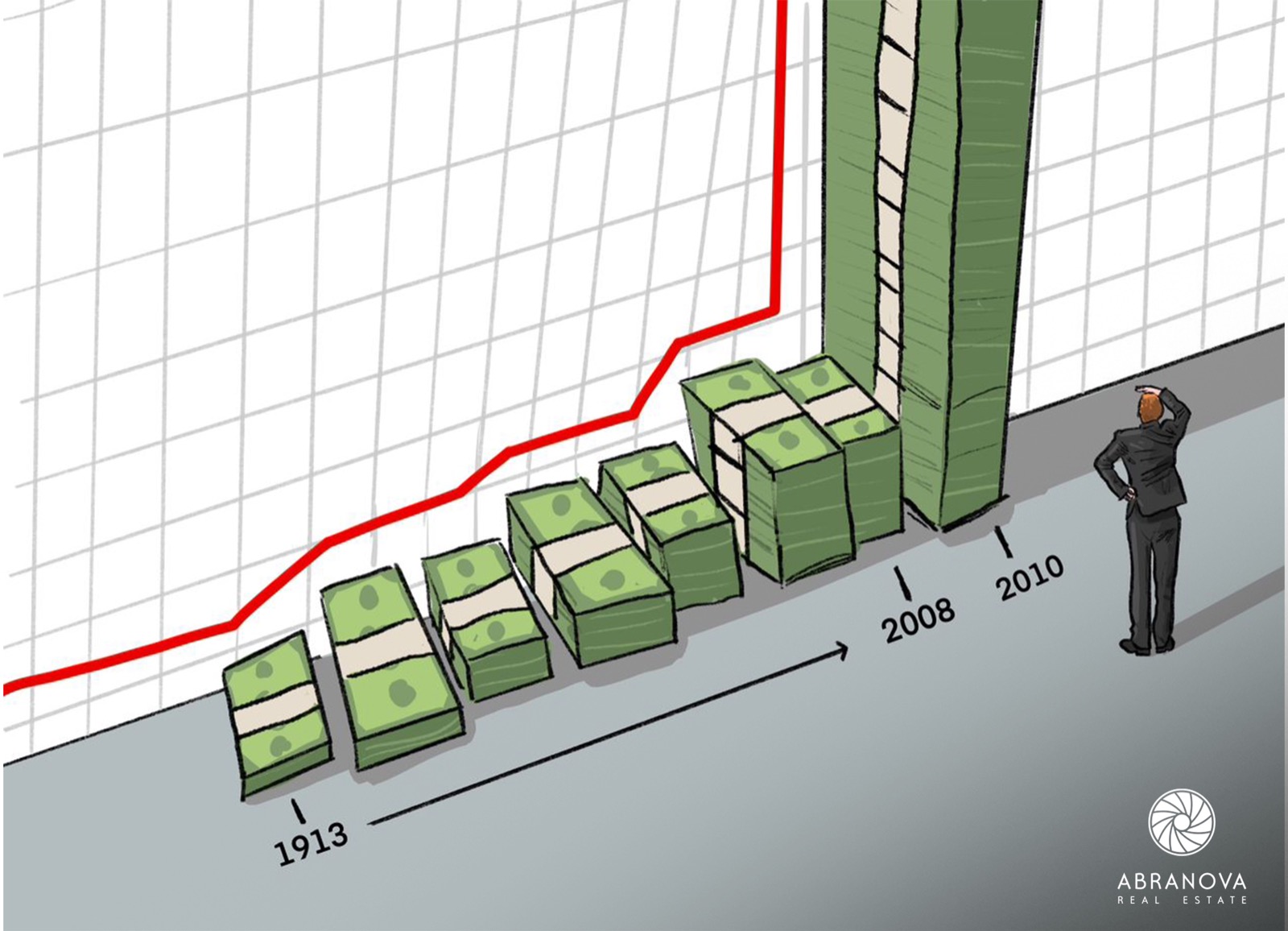

There’s no doubt that our success wouldn’t have been possible without our hardworking team, the strong relationships that we’ve built with our investors, partners, vendors, subcontractors, and everyone who deserves recognition — for that I’m eternally grateful. As Marks would tell you, the economic tailwinds that peaked in March 2022 when the Fed started raising rates — started with the overwhelming response the US government deployed in order to save the economy back in 2008. Most Americans are familiar with the Fed’s decision to drop the federal funds rate to almost zero at times of crisis. However, most don’t understand the mighty hand that this institution has in jumpstarting wealth creation cycles. Within the first two years of responding to the GFC, the Fed injected a century’s worth of liquidity into our economy. In 2010, the US economy had more money in circulation than we’d ever had since the inception of the Fed in 1913:

“Between 1913 and 2008, the Fed gradually increased the money supply from about $5 billion to $847 billion. This increase in the monetary base happened slowly, in a gently uprising slope. Then, between late 2008 and early 2010, the Fed printed $1.2 trillion. It printed a hundred years’ worth of money in little over a year, more than doubling what economists call the monetary base.” (Leonard 6)

Between late 2008 and early 2010, the Fed printed $1.2 trillion. It printed a hundred years’ worth of money in little over a year.

If that doesn’t seem like a staggering amount of money in such a short period, consider this. During the covid-panic, about $3 trillion was funneled into the economy within four months, from February until June 2020. About half of that amount was circulated within a Sunday, on March 15th, 2020:

“Powell’s Fed would do virtually everything that Ben Bernanke’s had done in 2008 and 2009, but this time did it in one weekend, rather than over several months. It slashed interest rates to near zero. It opened up their “swap lines” with foreign central banks, flooding them with dollars in exchange for their local currencies (this was important because so much global debt is denominated in dollars). It executed a new round of quantitative easing, worth a total of $700 billion, and bought the bonds at a faster rate than before. The Fed would buy $80 billion worth of bonds before the following Tuesday, meaning that it pushed as much money into the banking system in forty-eight hours as it had done in the span of a month during earlier rounds of QE. It gave forward guidance, promising to keep rates pinned near zero as long as necessary. And it launched all of this in one day.” (Leonard 267)

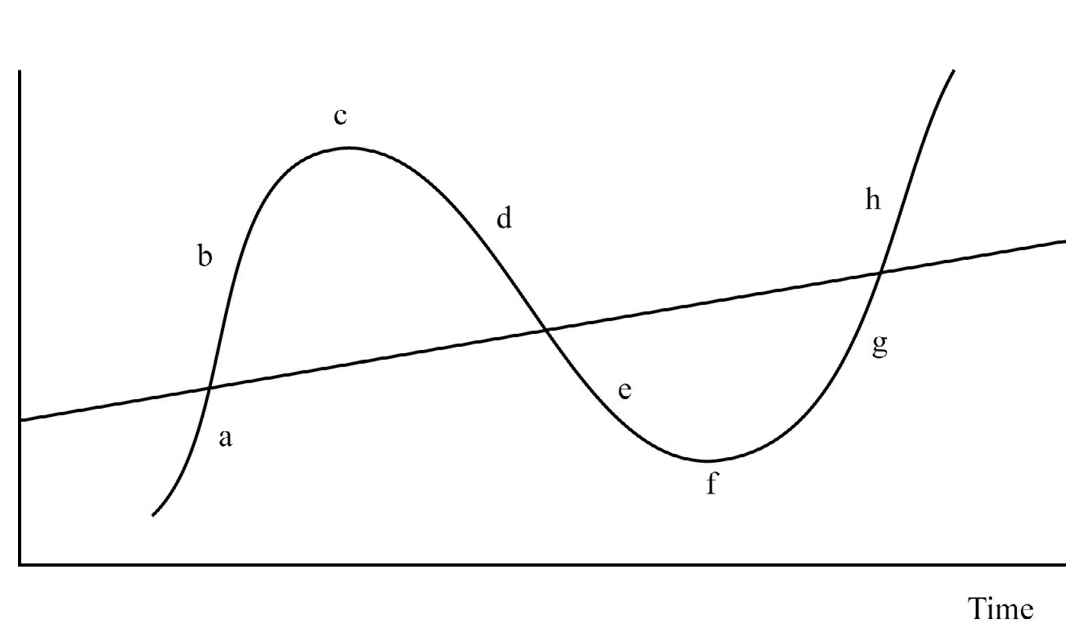

Circling back to Mark’s point on the inception of a market cycle, the avalanche of easy money that came by way of near-zero rates and quantitative easing policies brought with it one of the most significant asset booms in the US financial history. The stock market responded exuberantly, with every other neighbor and Uber driver seeming to strike it rich quickly. The housing market went through the roof, eager home buyers braved the heat and cold weather to line up — just to have a shot at putting their chips in the brutal bidding wars that had become rampant. Construction costs quadrupled, a piece of plywood that once sold for $6 was selling for $26 — if you could even find it. The culmination of such irrational market exuberance and rising inflation was the series of decisions that the Fed kickstarted on March 17th, 2022, abruptly raising the federal funds rate to historic highs and curtailing quantitative easing policies. This was the beginning of the downward cycle we’re now riding. The excerpt from Mark’s Mastering Market Cycles below phenomenally puts such cycles into perspective:

a) Recovery from an excessively depressed lower extreme or “low” toward the midpoint. b) The continued swing past the midpoint toward an upper extreme or “high.” c) The attainment of a high. d) The downward correction from the high back toward the midpoint or mean. e) The continuation of the downward movement past the midpoint, toward a new low. f) The reaching of a low. g) 0nce again, recovery from the low back toward the midpoint. h) And then, again, the continuation of the upward swing past the midpoint, toward another high. (Marks 33)

The Fed rose to the catastrophic occasion of 2020, without a doubt. In fact, most Americans don’t realize that if it weren’t for Powell’s swift response, the covid-panic would have caused an economic crisis far worse than the GFC, some economists argue that it would have been comparable to the Great Depression of 1929. However, the perfected response to save the economy from the covid-panic is arguably a result of the lessons learned from the impacts of the delayed response to contain the spread of the GFC. Not wanting to repeat the mistakes of his predecessors, Jerome Powell acted with incredible conviction, overwhelming markets with not only ample liquidity but also confidence and assurances to keep the rates at near zero for a prolonged period. With market participants flush with cash, this newfound confidence created even more complacency in how the market behaved. As a result, what was supposed to be a historic learning opportunity on how to navigate times of market crisis became the most euphoric moment to participate in them.

More surprising to me is the fact that even more veteran investors, industry heavy-hitters and even REITs got caught up in the tectonic shifts that were unleashed when rates started going up. We’ve seen the cascading collapse of SVB, Signature, and First Republic — toppling $532 billion in assets. We continue to see tension as landlords face a $1.5 trillion bill in commercial mortgages coming due in the next three years. You’d expect this kind of tightrope to hang only the untrained and inexperienced investors who entered the market during the boom of the last decade or so, this couldn’t be further from the truth. In my reflections, searching for insights to make sense of this, I stumbled upon The Myth of Experience, an incredible treatise by behavioral scientists Emre Soyer and Robin Hogarth. These scholars delve into how our experiences can sometimes serve as blindspots when encountering new and unfamiliar circumstances.

“In The Black Swan, Nassim Taleb describes how such rare yet impactful episodes develop — typically not in a simple, linear fashion, which can allow people to learn to manage them over time, but rather by appearing dormant or progressing very slowly until suddenly there is, in effect, an “explosion” with unexpected outcomes and irreparable consequences. The slippery slope leading to such disasters can be quite flat and easy to get used to. And the tranquil and seemingly familiar present becomes a mere distraction from imminent destruction, leaving the victims tragically unprepared.” (Soyer et al. 75)

There aren’t too many experiences that would’ve prepared us for what happened on September 11. In fact, our experiences had conditioned our brains that Boeing 767s just simply never hit skyscrapers, especially in the skyline of the great Manhattan — at the very epicenter of the financial capital of the world. How many folks who spotted Flight AA 11 from a mile away do you think would’ve bet that it was headed for the North Tower?

I see the tailwinds that ensued as the economy began to recover from the GFC as a series of white swans, dotted in low-interest rates, quantitative easing, and many government assurances that the Fed would intervene whenever needed to keep markets steady and robust. COVID-19 was a black swan event, but other black swans that passed for white flew under the radar — starting with the Fed’s unleashing of the money-printing press to save the economy. Although intercession was paramount, the extent to which the easy-money environment was conceived and prolonged will continue to be debated for decades. However, there’s no disagreement today that the market euphoria that was created encouraged further risk-taking, especially when the Fed had maintained the funds’ rate at near zero for over a decade. Massive purchases of treasuries and corporate bonds continued to inject more liquidity into the economy; real estate cap rates were falling below 3% in some markets; inflation was at an all-time high at almost 7%, I could go on. The question is, why were large investment firms still acquiring assets at such inflated values? What underwriting, investment theses, and value enhancement strategies still made sense even at valuations below 3% cap rates? How much better could a party like this ‘really’ get?

The myth of experience is to blame here. These decisions were made with the assumption that the white swans we’ve seen in the past will continue to adorn our skies, it didn’t help that the Fed kept assuring markets that inflation was transitory. However, I still don’t believe the aggressive underwritings of cap rates under 3% were justifiable. Such analyses left no margin for error in a likely scenario that the funds rate would return to historical norms.

“Experience not only fails to inform us about the existence of rare events, but about their impact as well. When it comes to unprecedented disasters, reliance on experience leaves us comfortably asleep at the wheel.” (Soyer et al. 75–76)

A security guard who’s worked at the bank for three decades without encountering any incidents does not necessarily possess three decades of experience, in fact his perception of having ‘experience’ may prove to be his own undoing. All it takes is that one little sleep, that one little slumber — that he’s gotten so accustomed to allow without any consequences over the years.

“Turns out I was right. Less than one year later, in 1974, the market crashed. Hard. Overnight, we were buying assets at 50 cents on the dollar.” (Zell 79)

Sam Zell was preaching raising rates, curtailing acquisitions and developments, and strengthening liquidity positions while the market was still raging hot — new funds were being raised, cap rates were falling, the federal funds rate was near zero and assets inflation was through the roof.

While the cost of capital has increased today, the cost of construction has significantly decreased. I should know this because, as full-stack construction developers, we track these construction market trends daily. Puzzling enough is the tendency for developers to pause new developments at times like these when rates are peaking and construction costs bottoming, supposedly to wait for the market to ‘recover.’ I may note that these are the ones who were bullish on new developments with lofty projections when construction costs were historically through the roof and cap rates were at an all-time low — fund rates near zero.

On the contrary, Marks insists that when everyone else is bullish, be bearish. When everyone else is bearish, be bullish. Extrapolating from this mantra, it’s pretty apparent that this is the time to be building anything at all. Once the Fed starts cutting rates and optimism returns to the markets, we’ll start seeing construction costs creep up once again as the pent-up demand steadily makes its comeback. The supply and demand fundamentals haven’t changed, statisticians cite a shortage of over five million homes in the US. So when we start seeing bidding wars, multiple offers, and term sheets — that’s the time to start scaling back on development. That’s the time to strengthen one’s liquidity position and stay put, waiting for the opportunity to capitalize on the cyclical nature of markets — they’ll always be cyclical as the participants remain human.

Sign up for my weekly newsletter: https://abranova.com/list/

Sources: