Abranova Inc

COMPANY OVERVIEW

Our team is made up of engineers and architects with a strong background in finance and data analytics, a rare combination.

Executive Summary

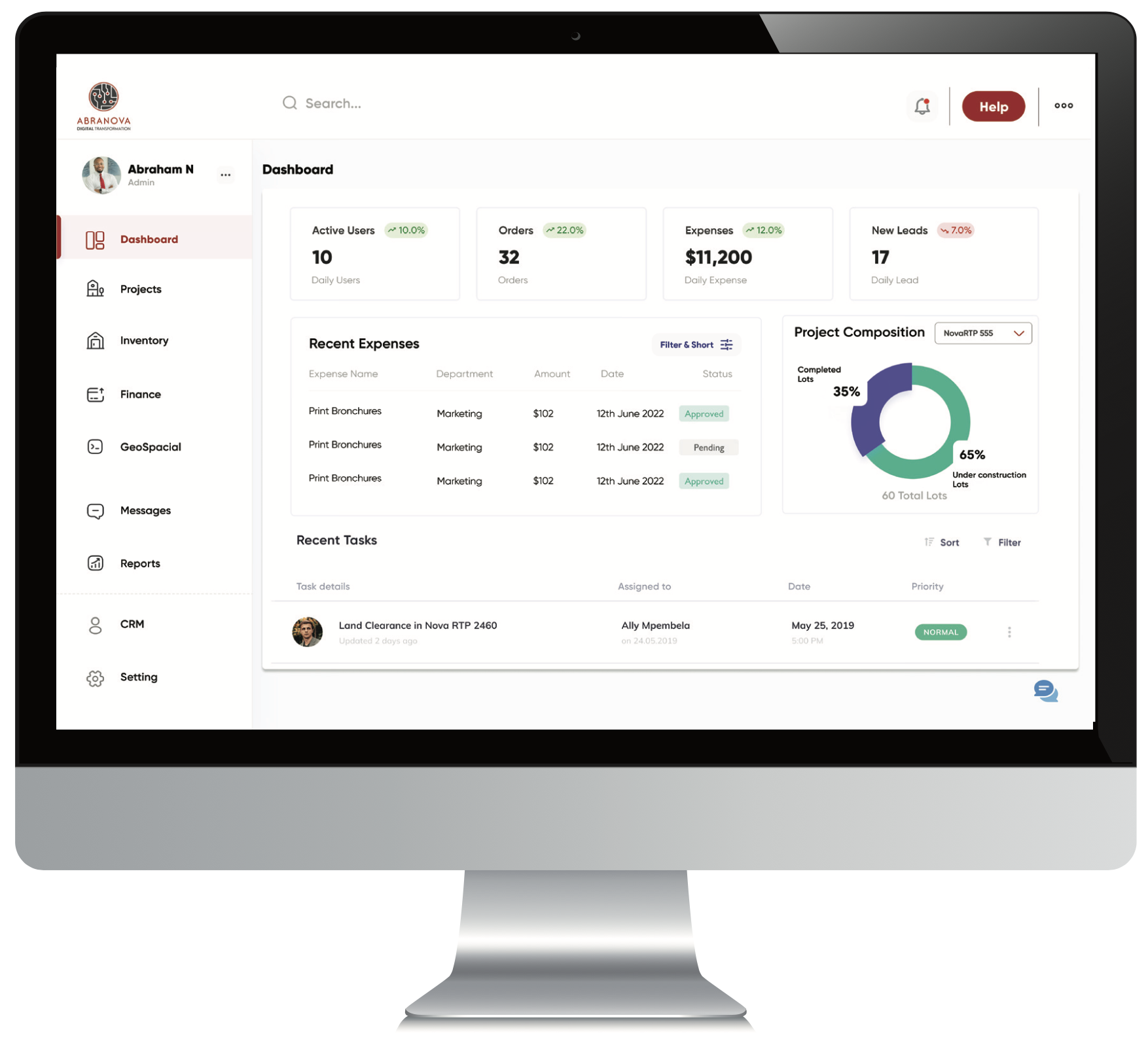

Abranova is a full-stack real estate investment and construction development platform. Using technology and a data-driven approach we identify unique investment opportunities for our investors. We’re vertically integrated to develop, construct and the asset manage our properties towards a successful exit or long-term hold.

As our underwriters we have a team of top-notch MBAs and financial analysts with a strong background in construction. We also have a marketing and sales team that processes thousands of leads and hosts property tours for prospective buyers or renters of our properties.

Entrepreneurial Hunger

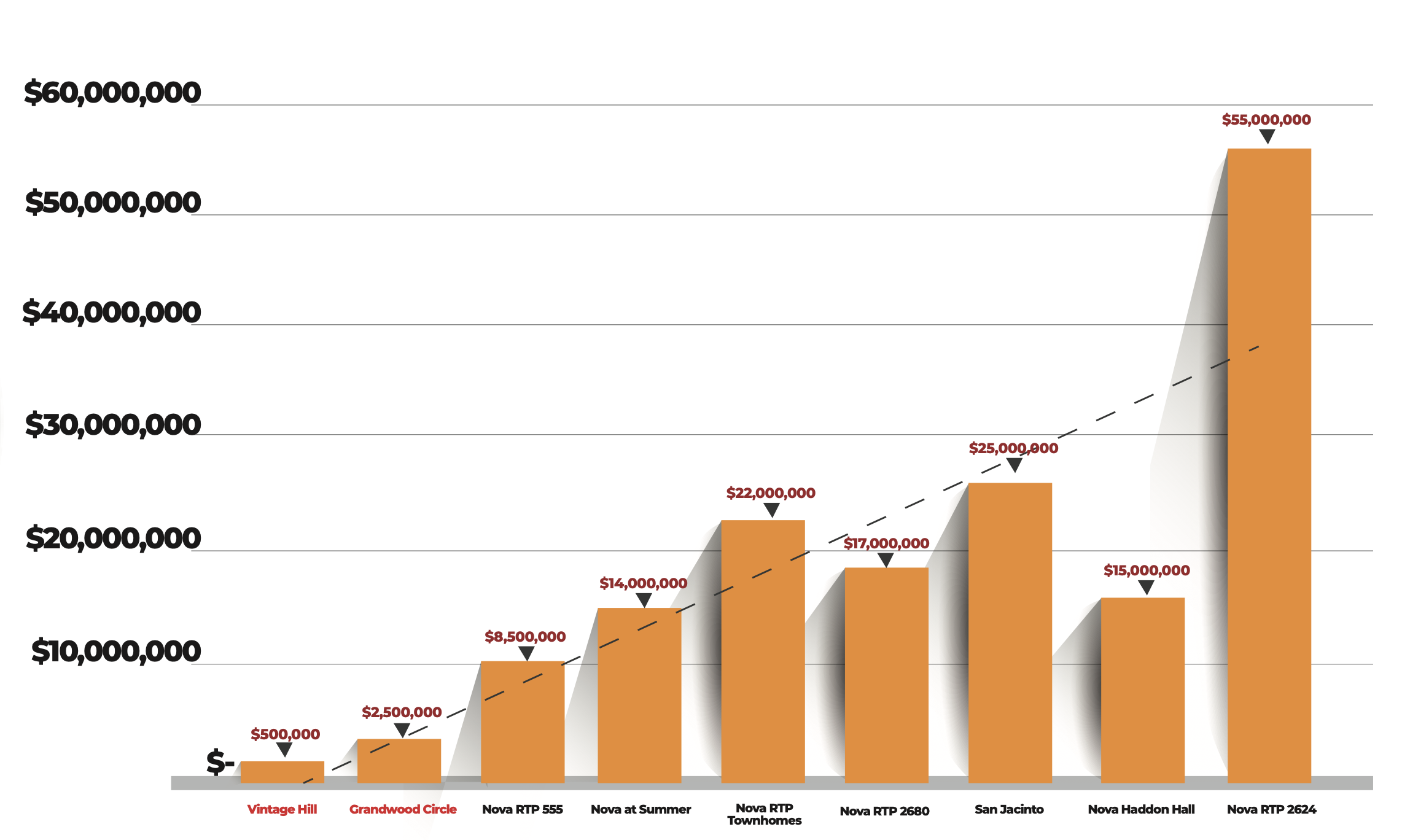

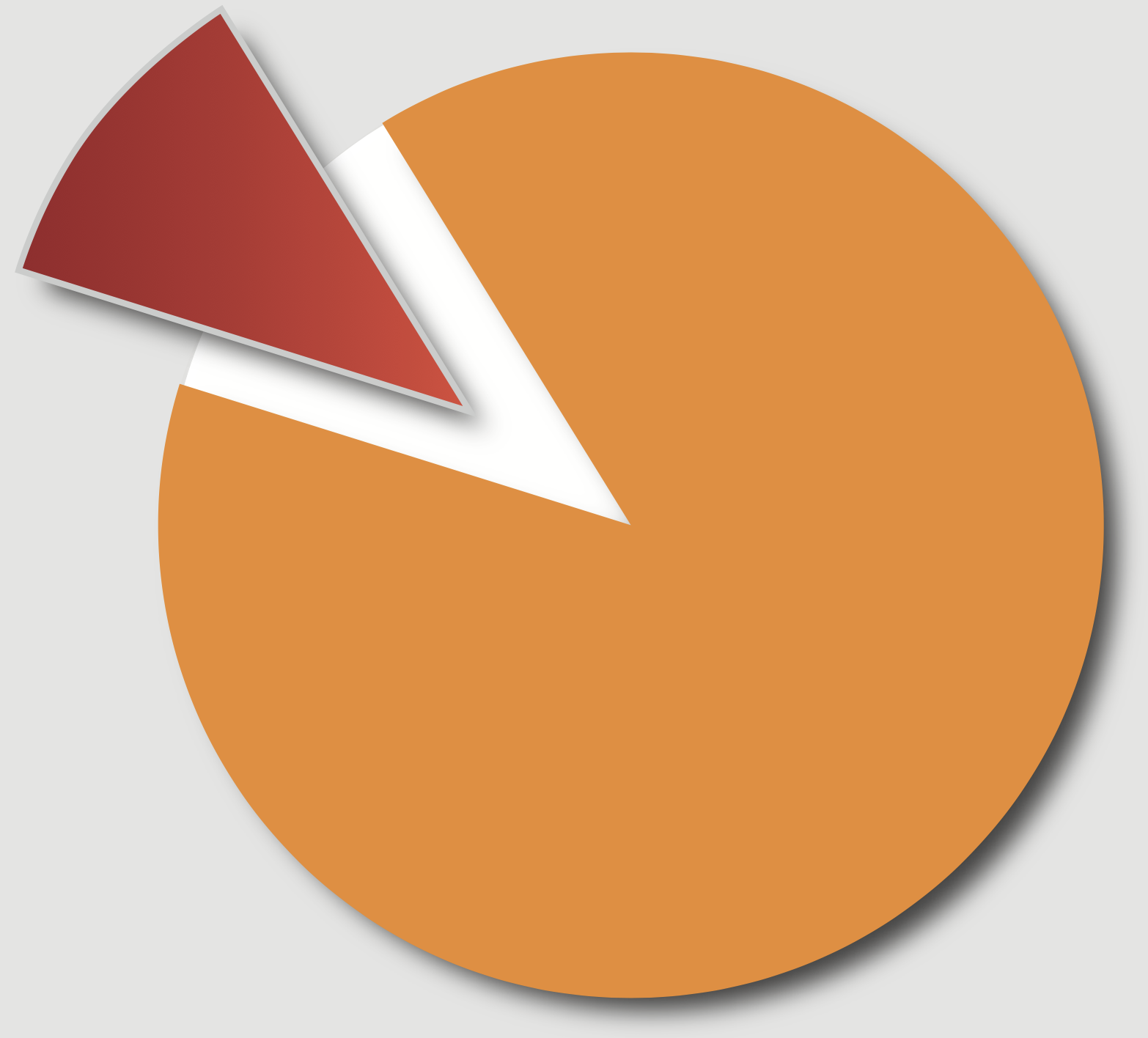

Abranova was launched with a streak of innovation on all aspects of the business, including its capital structure. According to Bloomberg, about 13% of American households qualify as accredited investors with a net worth of a million dollars or annual incomes of at least three hundred thousand dollars. According to Federal Reserve data, accredited investor households controlled roughly $73.3 trillion in wealth in 2020 – which is around 76.3% of all private wealth in America.

Abranova constantly seeks inspiration from the titans of the industry, one of which is David Rubenstein’s industriousness in capital formations and seeking investment wisdom.

Sam Zell’s ingenuity in real estate is only superseded by his drive as a businessman, his theories have been the founding principles of our vertical integration.

Innovative Capital

Since our founding in 2017, most of our capital comes f rom accredited investors through an SEC regulated framework. The investment offerings are based on the Jobs Act that was signed into law by Obama in 2012, which allowed non-IPO companies to raise capital from the public. We work with legal experts in the field to structure the investment offerings and file for all public disclosure requirements. Moreover we’ve ever since expanded our investors base to include high-net worth individuals and institutions.

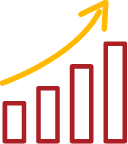

Our Performance

Since our founding in 2017, most of our capital comes from accredited investors through an SEC regulated framework. The investment offerings are based on the Jobs Act that was signed into law by Obama in 2012, which allowed non-IPO companies to raise capital from the public. We work with legal experts in the field to structure the investment offerings and file for all public disclosure requirements. Moreover we’ve ever since expanded our investors base to include high-net worth individuals and institutions.

The Team

Abranova is a vertically integrated real estate development company performing everything

from acquisition to delivery of ground-up or value-add projects.

Abraham Ng’hwani

CEO / Founder

The idea of a vertically integrated construction development firm evolved during his tenure as a preconstruction engineer; observing the inefficiencies that large contractors have normalized inspired him to found an investor focused development firm.

Our firm streamlines construction expertise, data analytics and a hands-on approach to the entire value creation chain of real estate development in order to create optimal value for investors.

Abraham believes in life-long learning, but he also graduated with a Mechanical Engineering degree from Duke University where he was a Reginaldo Howard Scholar.

He’s currently active with the Board of Visitors at the Pratt School of Engineering as a special guest, looking forward to serve on the board next year.

Abraham Ng’hwani

CEO / Founder

The idea of a vertically integrated construction development firm evolved during his tenure as a preconstruction engineer; observing the inefficiencies that large contractors have normalized inspired him to found an investor focused development firm.

Our firm streamlines construction expertise, data analytics and a hands-on approach to the entire value creation chain of real estate development in order to create optimal value for investors.

Abraham believes in life-long learning, but he also graduated with a Mechanical Engineering degree from Duke University where he was a Reginaldo Howard Scholar.

He’s currently active with the Board of Visitors at the Pratt School of Engineering as a special guest, looking forward to serve on the board next year.

FULL STACK

Construction

Development

Entitlements

Real Estate Investment

Property Management

SUMMER

MEADOW

TOWNHOMES

APARTMENTS

APARTMENTS

CONDOMINIUMS

BUILDING

FINANCIAL OVERVIEW

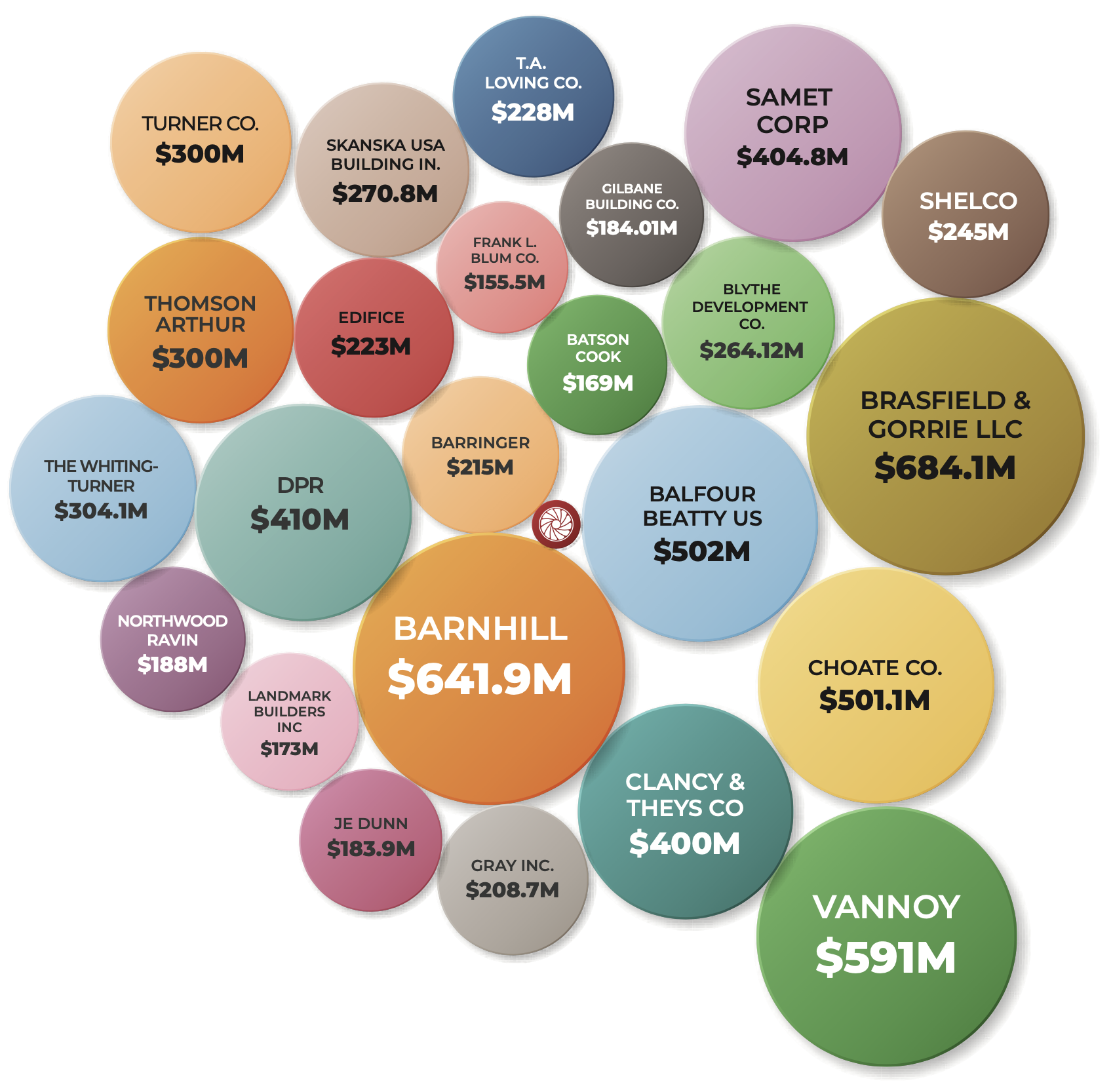

$16O MILLION DEAL VOLUME

Annual Revenues

THE OPPORTUNITY

Integrating development with construction provides opportunities for arbitrage and efficiencies, allowing real-time decisions to be made.

Culture and generational change has created a new class of construction professionals that are tech-savvy, innovative, and comfortable with a dynamic and changing world.

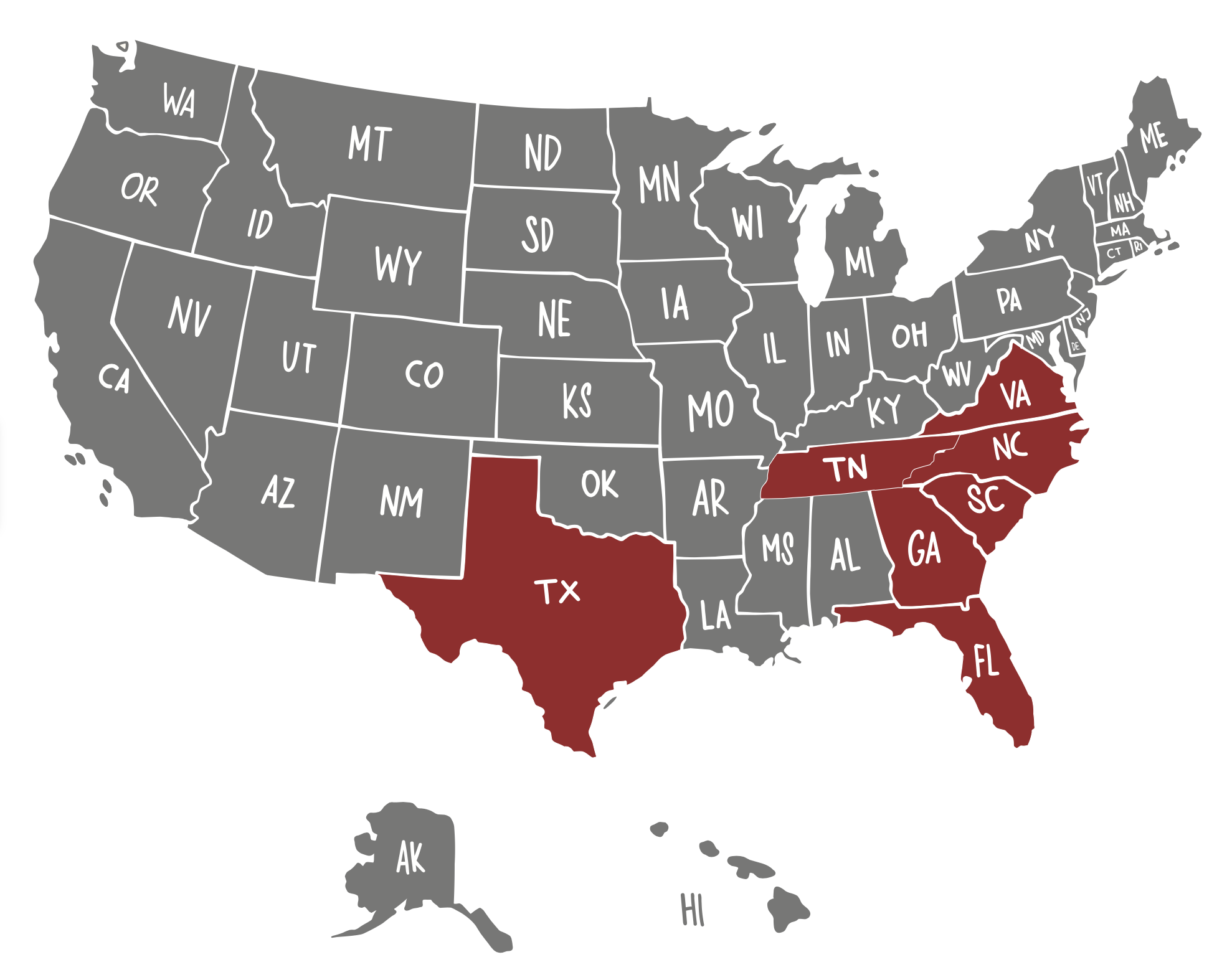

Ease of scaling a vertically integrated construction company across market around the country using technology platforms, travel, GIS and tracking technologies. I trained as a pilot.

Availability of tools to deal with massive amounts of data in order to drive decisions and growth or efficiencies in a way that wasn’t possible before.

Interdisciplinary sensibilities and connections of different industristries has created a talent pool that’s more readily available to bring transformative innovation in the construction development industry.

Dislocation between capital markets perception of value versus real construction values creates an opportunity for higher fee margins and profits.

Abranova is best positioned for ESG-driven investments and capital markets, ability to pioneer, innovations that will put us at the frontier of driving change. Starting to work with smaller businesses and building framework.

Mission-driven development development construction will help us create a culture and recruit top talent in the industry.

Makes clients very comfortable to know our problem solving abilities, because we’re vertically integrated and can break down problems and uncertainties into step by step to dos.

Optimizing project costs that can be turned into assets as opposed to liabilities, construction equipment leases, inventory of materials etc.

$10M for 10% of Abranova Inc.

Execute Our 5 Year Expansion Plan.

Bring In High Caliber People

Claudel Pressa

Chief Development Officer

Claudel is Partner with Abranova and brings over 16 years of real estate development,

finance and experience. asset management

Prior to partnering with Abranova, Claudel has been COO of a $5B vertically integrated developer-owner-operator in the multifamily, self-storage, mixed-use space and COO of a $3B KKR portfolio company in the single-family rental space.

Claudel previously co-founded and served as Principal of a New York City metro area real estate private equity firm, leading the development, leasing and financing of projects with more than $240M in total valuation. He began his commercial real estate career developing ground up projects nationwide at Prime Retail (acquired by Simon Property Group, NYSE:SPG, in 2010 for $2.3B). Claudel has completed over $2B in real estate development representing 3M+ sf of property.

Claudel is a member of the Florida bar and holds a general contractor qualifier license. He has a Juris Doctor, MS in Real Estate & BS in Finance, all from the University of Florida.

Dr. Salman Azhar

Board Member

Dr. Salman Azhar is a co-founder or a co-investor in over 125 startups. He has scaled organizations by forming teams and solving enigmatic problems. Dr. Azhar has 35 years of experience in industry and academia, during which he has crafted and led talented teams in developing and launching innovative technical solutions in cybersecurity, data analytics, artificial intelligence (including natural language processing & machine learning), medical systems, and financial systems.

Dr. Azhar is a Faculty member and Executive in Residence at Duke University’s Fuqua School of Business. He has previously served Duke as the Managing Director and Founding Member of Duke Capital Partners and as faculty in the Computer Science Department. Dr. Azhar is a Charter Life Member of OPEN Global and a venture partner at SAP.io, the University of Minnesota, and other organizations. He is an advisor to several companies, including Regiment Securities, ExpatBuddy, and Hurdle Health. His former business partners and clients include Honda, Toyota, Lamborghini, Audi, Sony, SAP, HP, ADP, jda/i2, Western Digital, Oracle, Agilent, Outcome, and several startups.

He is currently developing Big Data solutions, innovative technology initiatives, and grooming leaders. Dr. Azhar earned his M.S. and Ph.D. in Computer Science from Duke as a James B. Duke Fellow and a BS in Math and Physics from Wake Forest Univesity as a Carswell Scholar.

Lance Keller

Board Member

Lance Keller is an Arizona native that grew up in Tolleson and attended NAU where he earned a Bachelor of Science in Construction Management and was a member of the Lumberjacks basketball team. After graduating college, he took a job in homebuilding. In 1994 he went to work for KB Home where he moved up the corporate ladder and was promoted to Division Senior Vice President. Lance is an entrepreneur at heart and in 2003 he became a shareholder and president of Elite Communities. Under his direction the Phoenix-based homebuilding company was named one of the fastest growing in the U.S. by Builder Magazine. Lance is an entrepreneur at heart and has invested in a variety of business entities, but his primary focus is providing great service to Lifestyle Homes clients and doing so profitably. Lance is a member of the National Association of Home Builders and the Home Builders Association of Central Arizona. Away from the office, Lance enjoys spending time with his family and two dogs, relaxing in San Diego, or you will find building something mechanical or out on the water sports fishing.

Build Our Own Construction Operating System.

BE PART OF THIS

Why’s This A Historic Opportunity

The US needs to build over 5 million homes to meet the current demand of housing, this presents an enormous opportunity for Abranova to scale as a vertically integrated construction developer.

Wealth creation has created disposable and investable income in American households that continue to play a pivotal role in capital markets. The Jobs Act opened a door to the $73.3 trillion accredited investor capital in the US to non-IPO companies like Abranova.

Shifting wealth demographics in America has created diversity in capital and investment markets that has opened doors to minority-owned businesses to compete and attain substantial market share.

The crypto industry and the COVID pandemic has legitimized virtual platforms as a place to do business and make valid investment decisions. It’s much easier today to earn credibility as a virtual investment platform than ever before.

Access to information and data technologies has allowed us to create efficiencies and arbitrage opportunities in constructions costs management in a way that hasn’t been possible before.

Recent macroeconomic disruptions such as pandemics and inflation have necessitated companies adopting interdisciplinary sensitivities in order to drive innovation and deploy data analytical tools in order to create arbitrage and cost saving opportunities in construction.

The institutionalization of single family homes and townhomes, a once mom-and-pop asset class, has created tremendous opportunity for companies like Abranova to capture sizable market share in the build-to-rent construction development space. With growth, this will paves ways for us to not only enter and compete in other construction sectors but also attract institutional investors such as hedge funds to buy our stock when we’re ready to go public.

The GOAL

To Reach $0.5B Annual Revenues in 5 Years.

REFERENCE